Arweave's Composability Experiment: Exploring a Better NFT Market

Web3 is accelerating and Arweave will be adopted by more developers as an infrastructure, creating a new and richer ecosystem. PermaDAO is a community of co-builders for just this purpose. Everyone involved can find a role here to contribute to the Arweave ecosystem, and any proposal or task related to Arweave can be posted here and supported by the entire community. Join PermaDAO and build Web3!

Translator: Spike @ Contributor of PermaDAO

Reviewer: Xiaosong HU @ Contributor of PermaDAO

Foreword

The crypto market in Q3 2023 was an arena of Layer 2 excitement, while segments like "traditional" DeFi and NFT were a bit quieter, especially after Azuki's suicidal marketing. The NFT small-picture business has hit its nadir, while in terms of the broader Fed rate-hike and rate-cut cycle, it's still in an illiquid phase, with the amount of money allocated to the NFT market falling exponentially.

If we rewind time to Q2 2022, it can be seen that at that time, it was already in a decline period in the first bear market. Driven by the microclimate of the death spiral of Luna-UST at that time, the overall market trading volume fell by more than 50%, and the trading volume of the NFT category also fell sharply.

The current stage is nothing more than a dormant period of this long cold winter. In particular, the NFT composability innovation in Arweave has gone beyond the picture hype of ordinary NFTS and entered the true NFT composability category -- atomic assets, which can not only contain PFP, but can even include FT (fungible tokens) or all kinds of RWA assets. It is built on the Permaweb, which also means that it allows for the permanent storage of assets and gets rid of the ills of centralized manipulation.

NFT Market Segmentation: Finding Your Niche 📌

If the existing NFT market is segmented, it can be roughly divided into three types:

Exchange expansion: Binance NFT, Coinbase NFT, their main purpose for running the NFT market is to extend their own market space, and their operation mode is closer to the Token market (CEX/DEX) model;

By transaction type: Art: SuperRare VS full-category representative OpenSea, their differences mainly lie in the difference of transaction type, such as the selection of a specific art market or the whole category;

Public chain ecology: Typically like Magic Eden on Solona, the value of their existence mainly lies in the construction of their public chain ecology, which can be understood as NFT for NFT, ecology for ecology, which is an indispensable component of any public chain.

If the new NFT market wants to enter the market at this time, it needs to recognize its existing positioning. What kind of trading market it wants to be is more critical than what it becomes. In other words, is it the competitor or supplement of industry giants such as OpenSea, exchanges such as Binance, and other public chains?

At present, the most realistic choice is to cling to the project side and cross-chain. The project side does not mind more new markets, and the desire for the ecology of the public chain is engraved in the bones, so that it can temporarily avoid the edge of OpenSea and exchanges, or at least survive.

For example, Solona-based Magic Eden's total transaction volume once exceeded $1 billion. Its founder is a former Coinbase product manager. The public chain + exchange background makes it firmly occupy the ecological niche of a single Solona public chain. OpenSea's support for the Solana network can be seen as a direct result of the catfish effect.

Having established our position, we are all faced with an unavoidable dilemma: what should we think of OpenSea?

From the track record of ApeCoin's release, NFT combined with DeFi is a feasible road, then other models are still waiting for the outbreak period. However, the biggest value that directly captured from NFTs is still the NFT Marketplace. Up to now, compared with the real-world entertainment model, NFTs are still in a very early stage of development, mainly reflected in two points: one is that the proportion of PFP NFTs is too large, and the other is that OpenSea occupies too high a transaction volume. Even more than 90% of the transaction volume.

According to the innovation diffusion theory, the foundation of the monopoly giants in the early stage of the market is not solid, and there is still room for innovators to develop. After all, entertainment content in the Z era, including music, game props, and even personal social platform content, can be directly NFT.

The world has been bitter for a long time, and we can even list the seven deadly SINS of this dragon.

Not issuing coins, wanting to go public, high fees, centralized storage, opaque censorship, inactivity across chains, and most importantly, monopoly.

Among them, the first six are the cause, monopoly is the result. First of all, OpenSea has made a positive contribution to the industry. In the dark moment of the opening of the long bear in 2017, OpenSea has had the hard time the persistence. The big money, including Sand and BAYC, would have died directly due to a lack of liquidity.

However a non-issuer or even a direct IPO is not decentralized at all, and building a more decentralized NFT market is in line with everyone's expectations.

So why don't we like OpenSea and can't give it up? And why have so many people killed dragons, but none of them really succeeded?

To answer the question, OpenSea's biggest advantage lies in path dependence -- we are used to conducting transactions on it. For example, if Alipay wants to change the user group of WeChat, it involves the use habits of the entire social circle. If you are willing, I am not willing, then this matter cannot be moved forward, and OpenSea's user viscosity has formed.

It has been proved that the Token+ brush represented by LooksRare is effective in seizing the market, but there is still a long way to go from the amount of real users, such as X2Y2, Magic Eden is likely to face this problem:

In this case, beating OpenSea will be a long battle, but we can be sure that there are a few things we can do:

Unite more parties and blockchains, and steer clear of exchanges and OpenSea;

More decentralization, with a little less centralization every day;

Changing user habits is not something you can do overnight.

If we look at existing mature products, such as WeChat for social networking, PayPal for payment, Sotheby's for art, Google for search, and bureaucracy for organizations, we will find a more suffocating path entanglement. All of the above forms can be involved in Web 3.0. Please note that it is involved, not included. In a decentralized world, there is no concept of absolute control.

Friend.Tech for social in the Web3 era; Arweave for information storage in the Web3 age, which is the first step in building information retrieval; PermaDAO for organization in the Web3 era; Not to mention that any everPay product already has payment functionality that works seamlessly with Web3.

In this case, OpenSea will be an example to prove the centralization of Web3, which makes sense on the surface. First, OpenSea occupies more than 95% of the market share of the NFT exchange market, and its dominance even exceeds Binance's 60% share in the cryptocurrency exchange field, which is the absolute industry benchmark. Second, OpenSea is not so encrypted, which is the industry consensus.

However, from the internal mechanism, Web3 cannot be represented by OpenSea, which is just like 8848 e-commerce platform is earlier than Ali, Yahoo is earlier than Google, the first card early, the market share is naturally high, but over time, only the product that really conforms to the logic of the track can win.

This is not the logic of the argument, as V God said that centralization is the only way to achieve decentralization, but because the early market size is small, like crabs in a small pool, this is not true sea supremacy.

OpenSea isn't the only art platform in the Web 3.0 era

Even if OpenSea has the majority of the market, even if the monthly transaction volume exceeds $3 billion. We can still think of the NFT market as being very early days, similar to what Bitcoin was before 2011, not least because our current mainstream spiritual consumption is still not in the NFF market.

Compared with the total luxury market of $1.29 trillion, the game market of $180 billion, and the art market of $50 billion, the entire crypto art market is only a few billion dollars. Even with other NFT categories, it cannot shake the total amount of human consumer goods market.

Efficiency at its best: The assault on pure transaction models

Time is money, tradability is always synonymous with liquidity, but NFTS are slightly more complex, different from the uniform pricing mechanism and quantity model of FT (homogeneous token), even within a single NFT series, the floor price and the highest price may be very different.

The efficiency of market making has been seriously affected, and to solve this problem, three ideas have emerged:

From imitating homogeneous tokens to deconstructing the high threshold of blue chips, it is hoped that by increasing the number of retail investors, enough liquidity can be produced, and then the current NFT market pattern can be changed;

DeFi - ification. One is to imitate the market making model of homogeneous tokens, hoping to create enough liquidity by introducing various AMM models into the NFT market; The second is the lending thinking, using blue-chip NFTS as collateral, and then guiding liquidity on them, introducing retail investors into the pressure pool, and supporting the price of tokens.

Strictly speaking, this is a summary of Blur's market thinking. At its core, it is about serving NFT traders, meeting their specific and professional needs as a first principle, and enhancing the value of its platform.

It can be understood that the cause of NFT fragmentation is that its own value is not stable. If it is a series of NFTS, such as Crypto Punk, the token value is often unevenly distributed to each member, resulting in the turnover rate of the project is mostly contributed by the popular members. Until it enters a death spiral.

In terms of value discovery, NFTS differ from FT in that their value is calculated as a sum, as shown in Equation 1, while FT is calculated as the multiplication of the number of tokens and the price, as shown in Equation 2.

In view of this, value discovery must be the premise of value transmission, NFT must first solve the problem of pricing mechanism, and then the problem of transaction scale needs to be solved with liquidity, and the trading enthusiasm of NFT works is driven by the maximum psychological expectation of participants.

The representative of DeFi is sudoAMM, which is not very successful. According to Dune data, the approximate trading volume is only about $100 million, and the number of transactions is about 100,000. In the final analysis, NFT market making efficiency can not be compared with homogeneous tokens, and it is difficult to create enough liquidity when the overall market size is small. A clever woman cannot make bricks without straw.

And finally, Blur's success, in terms of meeting the professionalism of traders, whether it is the platform's market share of OpenSea, although Blur token has dropped from $5 a year ago to around 0.2, at least in the name of decentralization, it has done a strong fight against OpenSea.

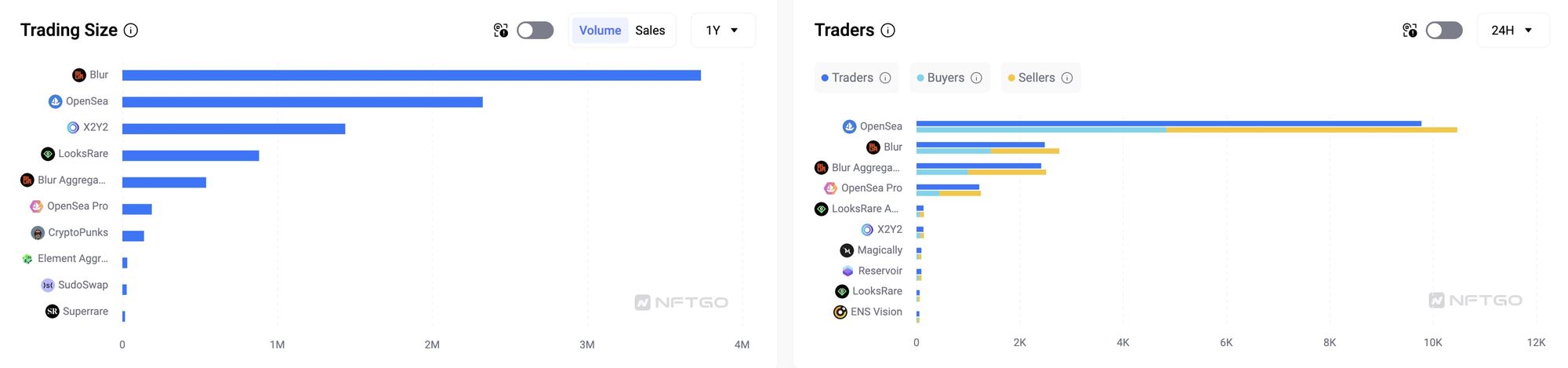

In terms of trading volume, Blur is far more than OpenSea, but in terms of transaction number, OpenSea is far more than Blur in terms of buyers and sellers. It is verified that Blur is more suitable for professional traders, highly similar to the difference between Curve and Uniswap.

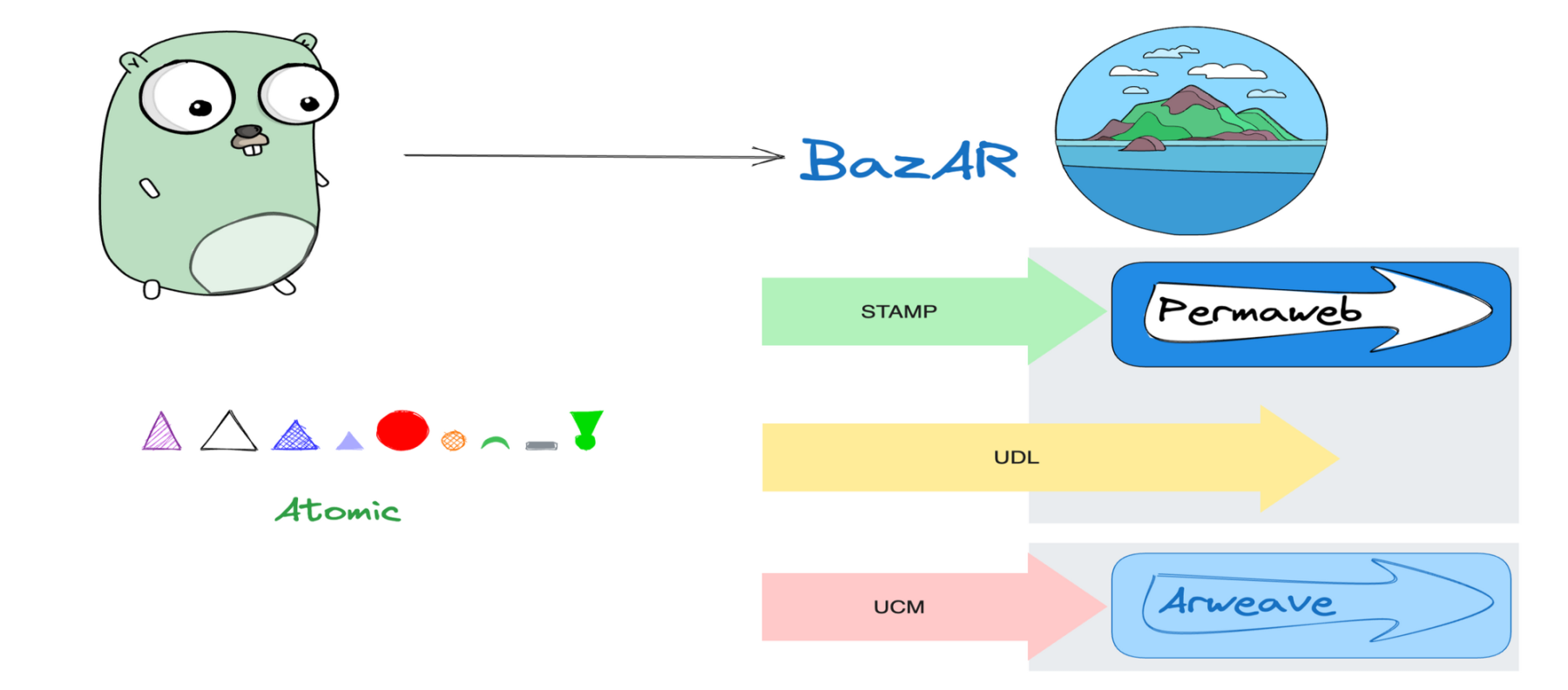

BazAR NFT: Native Composability

Arweave recently launched BazAR, an NFT marketplace built on Permaweb. First off, the NFT marketplace is more of an experimental platform to validate some of Arweave's recent major updates, such as Atomic asset trading and UCM/UDL/STAMP/$U. It is not intended to challenge Blur or OpenSea, which is the biggest difference from the aforementioned NFT platforms.

According to Arweave founder Sam, atomic assets on Arweave can be thought of as "asset data, metadata, and smart contracts all bundled into one Arweave ID."

As a result, atomic assets are essentially infinitely divisible and tradable through smart contracts, and NFT data is kept forever, while transaction records are updated. In the case of BazAR, there are some new changes:

PIXL tokens are available to use and earn, and are automatically issued daily to users who purchase assets on the BazAR marketplace;

Universal Content Agreement (UDL) can be added to any NFT uploaded by BazAR to ensure that the creator can track the changes of the NFT and can obtain continuous revenue from it to cope with the current royalty status and ensure the rights and interests of the creator;

The BazAR platform meets the Universal Content Market (UCM) standard, and users can directly eliminate any intermediary and royalty fees in the transaction process, and interact with Permaweb natiently.

In the NFT display list, users can use STAMP to rate different NFTS. STAMP is based on Arweave's evaluation system, and its tokens can be circulated, which means that users can get a share from the evaluation system.

It can be found that the technical composition of BazAR focuses on the composability of NFTS rather than focusing on NFT products or liquidity, and it is more to explore the future application scenarios of NFTS. However, in the current NFT market, whether it is zero royalties or centralized storage, the intrinsic value of NFTS is seriously harmed.

Final Words

If we believe that the process of human virtualization will further deepen, how can we evaluate the market value of Web 3.0?

And this value, if eventually proved to be unable to get rid of the control of centralized organizations, will eventually collapse, and then people will wake up from their dream.

These questions are not alarmists, but problems that must be solved in the future development of Web3. Just like the invention of Bitcoin, digital gold is the value anchor for human beings to enter the information age, which is inevitable in history, and Bitcoin bears this value as a kind of accident.

Back to BazAR, the trend is that NFTs are inherently flawed, and we need to replace them with something better, rather than focusing on immediate financial gains, as Sam, founder of Arweave, puts it, Arweave's UCM standard can also be used to exchange homogeneous assets, and if Uniswap X wants to be a better aggregator, Arweave and Permaweb are trying to create the never-ending NYSE and Sotheby's.

So the problem here is the choice of what measures to take in the face of developing problems. Of course, we can choose to watch a group of people "amuse themselves" from the perspective of negation and mockery, and stand on the dry bank to reflect on their "wisdom", but from a different perspective, we can use the way of the encryption industry itself to solve it.

🔗 关于 PermaDAO:Website | Twitter | Telegram | Discord | Medium | Youtube